I'm sitting at the Calgary airport waiting for my connecting flight on Christmas eve for the next 2 hours so I figured this was an opportune time to write me a blog posting. Yes, I am writing this entire post on my iPhone so please keep all your snotty comments about bad grammar and boring entries to yourselves! Christmas is a great time to get into more debt, but sometimes if we're lucky we get to receive some sweet-a$$ Christmas cash! In my last post I mentioned how I've been able to keep my costs to a minimum by doing a $25 gift card exchange which upon reflecting seems like a pretty stupid idea. Mainly because there is no love or thought going into the gift and I'm just going to end up with basically the same thing I gave.

I hate to say it, but by cutting out the shopping, it just doesn't feel like Christmas to me. Odd isn't it? I'm starting to believe the consumer whore side of me may have finally won me over! However once I look back at the amazing month I've had, I'm sort of proud of how well I did getting so much debt paid off and how much money I've saved on half my usual salary - in 2 months!! I'm not going to sugarcoat it though; Gail, I've let you down this month.

I've definitely gone over my budget each and every single week, but it was with good intention. I went to many holiday parties and birthday celebrations, but I did pay all my bills (less on my MasterCard than I had hoped) and I managed to only spend $150 on presents this year (which is a really big deal for me). Not to mention I have yet to touch my savings and that feels as good as sunlight feels to a cat warming its a$$ by the window.

So now it's time for me to strategize; I'm about to go without 2 weeks worth of pay while on vacation, and I'm not going to get my next paycheck until February. The good news is that I've already paid my rent for January, but I've only got $900 to live on until Februscary. I'm expected to go half on Santa's happy funtime elixir (aka alcohol) and pay $100 for a hotel room in small town Alberta (that's the cost for two nights - jealous?) for a wedding this New Years, and I'm on vacation for 12 days which usually translates into eating out every day (not that kind of eating out - get your mind out of the gutter) which really drains the bank account in a hurry. Holy moley guacamole, what am I going to do?

Well, here's my plan: I'm going to learn to live with less this Christmas, cut back on the booze, and steal all the leftovers from every Christmas/holiday dinner I attend. I may end up looking like a fat butterball at the end of this vacation, but dammit I will leave my savings alone for as long as is humanly possible. I mean, why go two steps forward and one step back? Who the fox am I, Paula Abdul?

Merry Christmas loyal readers. I hope that this post finds you in good spirits over the holiday season.

Love always,

John

Friday, December 24, 2010

Saturday, December 11, 2010

Be a Chriftich (Thrifty Christmas B!tch)

|

| Santa Claus is Coming!! |

The holidays are definitely the most challenging part of my financial journey. I just want to go out and buy all sorts of presents - for myself! Not only is there that societal pressure to buy gifts for your family and friends, there are also those unheard of charities that only seem to show up at the holidays.

“Hey John, can you spare $5.00 for this family of refugees from Utah whose parents have bum cancer and a 7 year-old who is a recovering crack addict with 3 dogs that need hip replacement surgery after slipping in the ice on their way to the family’s great-step-aunt-who-just-moved-from-Clevland’s funeral for her cat Mittens?”

Add in the fact that for some reason many of my friends are having birthdays and holiday parties every other day this month and I’ve got all those extra expenses of bringing snacks and cookies, and buying tacky Christmas sweaters. It seems my money is just asking for me to pull it out and slap it down on the counter for some greasy cashier’s hand to grab it and play with it. Christmastime is certainly proving to be a challenge.

I’ve been depriving myself of all my wants for a couple months now and it has been so freaking challenging; however my will power is unwavering. For example, I saw a great t-shirt that would be a great gift for my partner, but it was $40! Back in the old days, I wouldn’t blink an eyelid at $40! I’ve spent $90 on a t-shirt; heck I’ve spent $300 or more on my partner on multiple occasions! And then that’s when I remember that my stupid spending is what got me into this fiasco of a clustertruck of a situation that is $40,000 of debt. So what, oh what can I do to stay on my crazy $100 of spending per week budget? I only have $40 per month set aside for gifts, so it’s looking like shopping is completely isn’t happening and prostituting myself around the neighbourhood for extra cash is out of the question – those ladies down on Dalhousie are just way to sexy to compete with! Then I got an idea! An awful idea! THE CHRIFTICH GOT A WONDERFUL, AWFUL IDEA! "I know just what to do!" The Criftich Laughed in his throat. And he made a quick Santy Claus hat and a coat. Oh $hit, wrong story; but seriously, I did get an idea.

I’ve been depriving myself of all my wants for a couple months now and it has been so freaking challenging; however my will power is unwavering. For example, I saw a great t-shirt that would be a great gift for my partner, but it was $40! Back in the old days, I wouldn’t blink an eyelid at $40! I’ve spent $90 on a t-shirt; heck I’ve spent $300 or more on my partner on multiple occasions! And then that’s when I remember that my stupid spending is what got me into this fiasco of a clustertruck of a situation that is $40,000 of debt. So what, oh what can I do to stay on my crazy $100 of spending per week budget? I only have $40 per month set aside for gifts, so it’s looking like shopping is completely isn’t happening and prostituting myself around the neighbourhood for extra cash is out of the question – those ladies down on Dalhousie are just way to sexy to compete with! Then I got an idea! An awful idea! THE CHRIFTICH GOT A WONDERFUL, AWFUL IDEA! "I know just what to do!" The Criftich Laughed in his throat. And he made a quick Santy Claus hat and a coat. Oh $hit, wrong story; but seriously, I did get an idea. I hate to be the one to break it to you, but presents really don’t mean $hit in the grand scheme of things. Sure I love to give presents, but I really don’t care much if I’m not receiving them. One thing that I learned when I moved far away from my family is that (sorry this is where I get sappy, cheesy, and/or cliché so feel free to stop reading, I won’t blame you) the time you spend together is what you remember. I can’t tell you all the Christmas presents that I received, but I can tell you about all the great times I have had during the holidays. There was one year that my Grandma gave my cousin this ridiculous dancing chicken and by the end of the night we were all hammered and used the video camera to record a video of it with this little scarecrow thing looking like they were having sex while we’re all pissing our pants laughing. It was pretty hilarious, and you can watch it here! Another hilarious Christmas time memory was last year when my roommate (as well as everyone else) had one too many glasses of eggnog and starting dancing all over the apartment by herself and THAT video is here!

See, gifts don’t mean anything; it’s the memories that are what really count.

So how do you get out of buying gifts for everyone? Do what my family does; have a Secret Santa gift exchange and only buy 1 present instead of dozens. We do Secret Santa for the whole crew, including parents, grandparents, partners, etc AND WE SET A SPENDING LIMIT! In the beginning we didn’t really do this and it turned into more of a pi$$ing contest to see who could buy the best gift (and then I started blowing away the competition with my cheap and thoughtful gifts). That’s why now; we take out the shopping and each buy a $25 gift card - so simple. I did all my Christmas shopping on my way home from work and it only took 5 stinkin’ finkin’ minutes.

Another great way to save money is to host a Christmas Party potluck and have all the guests bring something to snack on. That way the costs are cheap for all and you all get to have a great time hanging out together. Scrap the gifts for friends, and instead give them some good times together! If you really need to get them something, think about making something cheap like a scarf, or a scrapbook of photos, or even some Christmas baking (my friend Caitlin has a ton of great ideas here). The point is, being cheap at the holidays is the new cool thing to do – because I said so!! Keep your spending in queue and you’ll be laughing all the way to the bank in the New Year. The banks will effing hate you for not using your credit, and that my friends, is the true meaning of Thriftmas!

Happy holidays!

John

Tuesday, November 30, 2010

Motivate Your Pants Off!

|

| This girl is not Justin Bieber, but you can't tell the difference. |

So many of us want everything right now and don’t want to wait for it; but where the buck do we get the money to pay for this $hit? Your credit cards are certainly not going to get you out of debt and they aren’t going to teach you sweet-tweet about how to save up and earn the things you feel so entitled to. The banks are screwing us financially as much as the Internet is screwing over the music industry – mainly from behind. Listen up people! If you don’t have any goals then you’re not going to win in the debt destroying game. What motivates the $hit out of you? The $14 an hour job you hate; $40,000 of debt that you’re stuck with; expensive rent; the fact that Justin Beiber is a go$h-darn millionaire; your creepy roommate who collects toenail clippings and plans to make you a necklace with them for Christmas; what!? Setting a goal is incredibly important to keep you sailing toward the financial freedom oasis instead of down into the deeps of the debt toilet. So what motivates you?

|

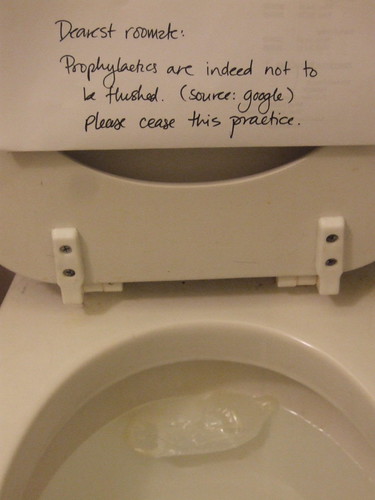

| Did you spend all your $ on prophylactics? |

I’ll tell you what motivates me; being debt-free. On my credit card bill alone, my accrued interest for one month is $134!! It’s heartbreaking to see more than my monthly food budget disappears as interest. If I can get that bill paid off, that will allow me so much more financial freedom in itself. I had an incredibly happy moment yesterday when I opened my credit card bill. I used to HATE opening any bills and I’m not even kidding, when I started this debt-tackling process, I hadn’t opened my MasterCard bill for SIX months! Talk about stoo-pid. Now when I get a bill, I open it right away and pay the crap out of it. So why was I so happy to see my MasterCard bill? There wasn’t a single purchase on it. No restaurants, no trip, no prophylactics, nothing; nothing except interest that is. You know what was even more exciting? I made $1,200 worth of payments in one month! AND I don’t have a minimum payment due because MasterCard is pi$$ing and/or $hitting their pants because I’m actually kicking my outstanding balance so hard in the ball$ that it’s barfing off the balance! This motivates me so much. I really dreaded seeing my balance on my credit card, but now I look forward to my letter of “congratulations” from them. It’s not just MasterCard, it’s all of the bills which make me feel good about myself. I now have all my accounts as “hot links” in my Internet browser so that I can instantly check where I’m at with my balances. It’s such a liberating feeling to not worry about how much money I have in my bank account.

Having an emergency fund is another source of motivation for me. I recently got let go from my job and now I’m making half of what I used to (don’t worry, I’m working on getting a better or second job in the meantime). It’s a real betchslap to the face to lose so much cash, but lucky for me, Gail talked me into getting an emergency fund so I’ve been putting 10-15% of my paychecks into savings so I am covered for another month or two. If you’re thinking that your line of credit or credit cards are your emergency fund, you’re a fracking dumba$$. Get working on an emergency fund now. Even if it’s only $10 a week, it’s something.

Let’s see, what else, oh yes, paying rent is bull$hit. I would really like a condo of my own and make some equity on instead of dumping thousands of dollars a year into some heartless ba$tard rental company’s pocket. I’m not stupid though, I want to have a solid down payment for my dream place. I’ve learned from watching a number of reality tv shows that I will most likely get approved for a mortgage that is 3 times what I make annually, so I would need a sizeable down payment for my first place. Not-to-mention there are a ton of other costs and fees that people don’t even consider such as taxes, moving costs, agent fees, lawyer fees, and the list goes on. Getting approved for a mortgage without having to put any money down is feather-pluckn insane.

Another goal for me is being my own boss. My family is full of entrepreneurs and I definitely have the entrepreneur blood in me. I would love to be my own business one day so that inspires me to get my debt under wraps. I may need to take some courses or something, so this is more of a loose goal for me at this point. I know that I feel a little trapped in my job because I don’t get to use my brain that often, but it pays the bills for now and keeps me going; lucky for me (and you) that I get to use my blog as a creative outlet in the meantime!

Seeing your goals through to the end is really hard to do, especially when you’re so used to getting everything you want so instantly, but the key to success is remembering to treat yourself in small ways along the way. If you pay off a debt, take a day off at the spa with some of your savings, take the family or friends out for a staycation (a vacation in your hometown), or buy yourself a fancy new whatsamahoosit that you’ve been eyeing up for the past forever. My next mini goal is to get the credit card paid off and have me one heckuva hootenanny with all my friends! Stay on track and remember that we’re in this together! And to prove it, I’ve posted my standings at the side if my blog to show where I’m at with my repayment and where I’m at with my savings so you can get inspired to set your own goals. Meanwhile, my roommate's new toenail necklace is almost complete!

Lots of love!

John

P.S. That feather-pluckn link is the first album I ever purchased. Oh memories.

Monday, November 22, 2010

Tobacco Free Spanking Account (TFSA)

|

| Saving and Shaving are completely different things |

Think about it - I mean really think about it. Most of us would like to retire today even though we still have a good 25 years left in the workforce, but that’s just not affordable. I would love to retire in my 50s and nowadays, we all are living well into our 70s, 80s, 90s, and oh god, 100s. If I live that long I really hope that I get to be that crazy crotchety old man who yells at teenagers to get off their hover-boards on the sidewalk! Imagine, if you’re living another 20-40 years after you retire, you better have a solid plan to make sure that you aren’t living on cat food and Melba toast. Figure out what you would need to spend every year to live comfortably. Consider that you already own your house and your debt is paid off so you really only need some money to eat well, pay utilities, buy all your crazy medications, and spoil your grandkids. I think this is all possible on around $1,000 per month. Now there are 12 months in a year, and you want to be retired for 30 years, that means that you need to have $360,000 in the bank to live comfortably for 30 years. How in the hell is this even possible?

Well the trick is to focus more on baby steps to establishing a savings. A general rule of Gail is that you should put away 10% of your income automatically into savings. What do I mean by savings you ask; well, this would include your retirement savings, long-term planning savings goals, and emergency fund. Yes, I said emergency fund; and FYI, new shoes are not an emergency - seriously. Doing this is simple, whenever you get a pay cheque, figure out what 10% of it is, and put it into long term savings. There are many benefits to saving, but one of the greatest ones is that you can get tax breaks from the government for doing so. That’s right, you can get actually save even more money by saving money! For example, if you’re looking to build an emergency fund, consider a tax-free savings account (TFSA). Almost every bank offers them, and the best part is, you can put $5,000 every year in there without getting taxed on the interest – how cool is that?

Now, since we’re on the topic of opening a new account, consider this: you do not have to stay with the same bank to open a new savings account. Since you love to shop so much, start shopping for the best accounts among the banks. They all want your business, but it is completely unnecessary to stay with only one bank. When you’re choosing a TFSA, watch for the interest rate, user fees, and accessibility. Paying a transfer out fee of up to $100 (I’m looking at you CIBC) on your money is completely counterproductive. If you put $5,000 into your account and let it sit for 1 year at a 1.25% interest rate you are only making $62.50 that $100 will gobble up all the interest you made, and then some. I did a little research and Redflag deals did a nice chart which compares a number of banks here in Canada November 21, 2010 :

Transfer out fee: No

Interest Rate: 1.75%

Minimum Investment/Deposit: $50

Check Interest Rate Online: Yes

Transfer out fee: $100

Interest Rate: 1.25%

Minimum Investment/Deposit: $25

Check Interest Rate Online: Yes

Transfer out fee: No

Interest Rate: 1.50%

Minimum Investment/Deposit: None

Check Interest Rate Online: Yes

Transfer out fee: $50

Interest Rate: 1.25%

Minimum Investment/Deposit: None

Check Interest Rate Online: Yes

Transfer out fee (quoted from their website): “Fees: ICICI Bank shall be entitled to receive a fee upon transfer of Account funds to another financial institution. Fees in effect at the time the Account is opened shall be disclosed to you in writing at that time. ICICI Bank reserves the right to amend these fees from time to time subject to minimum 30 days notice to you and where necessary to Federal and Provincial tax authorities.”

Interest Rate: 2.00%

Minimum Investment/Deposit: None

Check Interest Rate Online: Yes

Transfer out fee: None

Interest Rate: 1.50%

Minimum Investment/Deposit: None

Check Interest Rate Online: Yes

Transfer out fee: $50

Interest Rate: 1.50%

Minimum Investment/Deposit: No

Check Interest Rate Online: Yes

Transfer out fee: $50

Interest Rate: 1.25%

Minimum Investment/Deposit: $100 or $25 with a monthly automatic withdrawal

Check Interest Rate Online: Yes

Transfer out fee: No

Interest Rate: 1.25%

Minimum Investment/Deposit: No

Check Interest Rate Online: No (according to the person I talked to on the phone)

Transfer out fee: None (but the person I talked to didn’t seem to understand what I was talking about so there might be a fee depending on what you’re transferring the money to)

Interest Rate: 1.25%

Minimum Investment/Deposit: None

Check Interest Rate Online: Yes

|

| A bee with an itch is a nice way to say b!tch. |

TFSAs are great for when you need your savings to be a little more liquid, i.e. for an emergency fund. If you’re planning to do some more serious long-term saving, start looking into RRSPs and GICs, which I will go into more detail in another blog. Keep up the good work and you’ll have so much money in the bank that those people who were taking your money in interest will have the roles reversed for a change!

Smell you later!

John

Sunday, November 14, 2010

Say “Suck it!” to Credit

Debt, debt, and more debt. If you’re as “lucky” as I am, you have lots of different creditors lining up every month to have their way with you and take your cash. Whether it is the studly student loan, the oh-so-seductive credit card, or even the sexy line of credit, they always seem to seduce me into giving them my money – and believe me, none of them leaves me feeling satisfied or proud of my time spent with them. At the end of each month I feel so ripped off because so much of my money is being pi$$ed away on these temptresses - a whopping $353.31 in interest to be exact! In this article I hope to help you resist these suave creditors and remind them that “no means no!”

Debt, debt, and more debt. If you’re as “lucky” as I am, you have lots of different creditors lining up every month to have their way with you and take your cash. Whether it is the studly student loan, the oh-so-seductive credit card, or even the sexy line of credit, they always seem to seduce me into giving them my money – and believe me, none of them leaves me feeling satisfied or proud of my time spent with them. At the end of each month I feel so ripped off because so much of my money is being pi$$ed away on these temptresses - a whopping $353.31 in interest to be exact! In this article I hope to help you resist these suave creditors and remind them that “no means no!”I have four different kinds of debt that I am currently paying off (successfully – woohoo!): my MasterCard, student loan, student line of credit, and regular line of credit. Each of these lovelies has their own interest rates and terms. It’s pretty gosh darn important to make sure that you figure out what you’re paying in interest for each of your debts if you’re starting a debt repayment process. This is the part where you have to do a bit of work, I know, I know, you can’t do this while you’re at work surfing the internet, so when you get home grab all your credit statements – it’s spreadsheet time!

My “new roommate Gail” has a book that is full of wonderful tools to help you get your debt in order. This exercise is a summary of what she taught me in her book. Let’s start with a credit card bill (because these are usually the most awful). Find your current interest rate (the rate should include the prime interest rate to get your total); in my case my MasterCard rate is 12.5%. Now take the amount that you owe to the credit card; I’m an excellent spender of other peoples’ money so my balance when I did this exercise was $14,581.45! Try and beat that! Actually if you do have a higher balance than that you REALLY need to follow financial blogs religiously and set your credit card on fire RIGHT NOW!

Take your balance and multiply it by your interest rate to find out how much you’re paying in interest every year. For example $14,581.45 x .125 = $1,822.68 = Bull$hit! Think of all the great things I could be getting with that money! That’s an all-expenses-paid trip to Cuba

Debt | Interest Rate (%) | Amount Owed ($) | Annual Cost in Interest |

MasterCard | 12.50% | $14,581.45 | $1,822.68 |

Personal Line of Credit | 10.25% | $4,991.57 | $511.64 |

Student Loans | 5.50% | $9,174.74 | $504.61 |

Student Line of Credit | 4.50% | $8,445.36 | $380.04 |

When you add it all up, I’m paying $3,218.97 in interest only - every year! Now you look at these numbers and think, well I only have a student loan and I’ll have it all paid off in 9 years using their payment plan. Okay, let’s say you have a $20,000 student line of credit at an interest rate of 5.5%. If you only use the plan given you by student loans, in 9 years you will pay $12,381.89 in interest alone! Don’t believe me, calculate it yourself here.

|

| I'm fuh-reaking out!! |

So now you’re freaked out and you’re saying: “Help me John! Help me!” Okay, since you were nice enough to read this blog and send me those scandalous pictures of you I will help. If you want to save some money and avoid the interest monster, you’re going to have to bite the bullet and commit to paying off your debt faster. I gave myself 3 years. Most people should be able to get rid off all their debt in three years. It’s a really tough thing to do at times, especially when you’re on your own and trying to get rid of $40,000 of debt on less than $50,000 annually but you can do it!

The first part to Gail’s amazing debt repayment tool is figuring out how much you are paying in interest each month. The formula for this is TOTAL DEBT multiplied by INTEREST RATE divided by 12. My MasterCard monthly interest is $151.89! Next part is to take the balance that you owe for each of your debts and divide them by 36 (3 years, 12 months in a year) to figure out how much you need to pay to get the debt paid off in 3 years. For MasterCard, I need to pay $405.04 each month. Now add the two numbers together to calculate what you actually have to pay each month. My monthly MasterCard payment to get my debt paid off in 3 years is $556.93. Do this exercise for all of your debts and you’ll get numbers like this:

Debt | Rate | Amount Owed | Monthly Interest Cost | Payment Cost | Average for paying off in 3 years |

MasterCard | 12.50% | $14,581.45 | $151.89 | $405.04 | $556.93 |

Personal Line of Credit | 10.25% | $4,991.57 | $42.64 | $138.65 | $181.29 |

Student Loans | 5.50% | $9,174.74 | $42.05 | $254.85 | $296.90 |

Student Line of Credit | 4.50% | $8,445.36 | $31.67 | $234.59 | $266.26 |

Total | $37,193.12 | $268.25 | $1,033.13 | $1,301.38 |

Alright, you’ve got all the numbers crunched and then you say, oh $hit, I have to put how much of my effing money into debt repayment? At least that’s what I said. I looked at these numbers and thought that my minimum payments were no where near these numbers, and they weren’t. Minimum payments are a horrible trick that that banks came up with to get you to think that you’re doing good because you’re making them, but you’re really not doing good for yourself, you’re just giving them more money which they really don’t need. If you want to get serious about kicking your debt in the ball$ you need to do this exercise and figure out what you should be paying. The longer it takes you to pay these mofos down, the more money you lose to interest.

As a Canadian, I am no stranger to snowballs so Gail’s snowballing trick is excellent and it works oh so well! If you have debt that is costing you a lot of money like my MasterCard and you have other creditors to pay, consider snowballing your payments. How do you do this you ask – here’s how. Identify your biggest problem debt (my MasterCard). Now, find out what your minimum payments are. You can find this by looking at your statements or simply calling your creditors. Take the total of your average for paying off your debt ($1,301.38) and subtract your minimum payments for everything but your biggest problem debt.

Debt | Average for paying off in 3 years | Snowballed |

MasterCard | $556.93 | $966.03 |

Personal Line of Credit | $181.29 | $141.94 |

Student Loans | $296.90 | $107.99 |

Student Line of Credit | $266.26 | $85.43 |

Total | $1,301.39 | $1,301.39 |

So now, I make $966.03 payments to my MasterCard instead of $556.93 and only make the minimum payment on my other debts. The reason I did this is to save money on interest. Once you have your biggest debt paid off, redistribute that $966.03 onto your other debts, and so on until you have no more debt! If you do the math, I will have ZERO debt in 3 years! How cool is that?

Still not motivated to put down your credit card? Consider this, if you can’t pay off your balance in full every month and you buy something (new clothes, a fancy meal, tickets to a Miley Cyrus concert – you’re only going to keep your friend company – riiiiiiiight) then think about how much it will really cost you. A new pair of jeans for $200 for example, will cost you $39 in interest over 1 year at 19.5% interest. Sure, it’s only $39, but that $39 could buy you a great shirt to go with those jeans. Why waste money when you don’t have to?

Listen, you can do this! If I can get my $hit together, anyone can. I know that I am a rare case for carrying this much debt amongst my friends (which is a good thing) but if you’re like me and you’re the lone wolf $hitting their pants over your debt, don’t panic for fox snakes, we’re in this together and we will kick this debt right in the pants!

*(hugs)*

John

Thursday, November 4, 2010

Give me some Credit

|

| Hooker boots are typically found in pay-by the hour "ho"tels. |

Let’s get down to the dirtiest kind of debt – credit cards. Credit cards can be a very helpful tool to help you buy the things you want right now. It’s all very necessary to book flights, rent a car or a hotel room. And let’s face it, any airline, car rental, or hotel that takes cash only is either sketchy, ready to break down, or has “by the hour” hotel rooms – yes I’m talking about hookers (another way to waste your money). I’ve been receiving a number of emails and phone calls from people telling me that my credit card balance is too high and my general response has been “no $hit.” Here’s some helpful info about credit cards I’ve learned and the steps I’ve taken to getting my credit card debt paid down.

| |

| Everyone hates telemarketers |

Little do my friends and readers know that I used to work for a credit card company as a telemarketer. I think it’s in the top 3 for worst jobs I’ve ever had. While there I learned a number of things about credit cards. The first one is that, if you think your credit card debt is high, it’s no where near what some people carry. I had one client want to do a $100,000 total balance transfer from their 7 credit cards. Talk about a nightmare! I felt like I was committing some kind of crime by signing this person for their 8th credit card. This leads me to the next thing I learned about credit cards; the more credit you apply for, the worse your credit history gets.

If you’re one of those people who are constantly applying for every credit card out there to receive a free hat, beer mug, or whatever else they are offering and know that you’re going to be rejected, I’m warning you that this probably isn’t a good idea and if you’re applying to get more credit to pay of your credit, you’re a flocking idiot.

Each time you apply, you’re allowing someone to search your credit history which can raise a few eyebrows to creditors. They start asking why you’re trying to accumulate so much credit and the more you’re able to dig yourself into a debt pit, the more of a risk you are to them. Keep your credit card number down to one, maybe two in the event that they don’t accept the kind of card you have but this is rare and you should be paying in cash anyway. The other thing I learned from working as a credit card salesman is that credit card companies are sneaky ba$tards.

Credit card companies care – about your money and their profits. When you’re paying interest rates like 19.5% on a $10,000 balance you might as well be walking over to your credit card company’s office with a box of condoms (safety first) and some Crisco and let them have their way with you. You are the consumer people! Don’t just settle for the first letter you get from some bank saying “you’re preapproved” because it’s all bull-hooey. I talked to all sorts of “pre-approved” people who made jack $hit for cash and had debt out the ying yang and I can guarantee that these people did not get approved even though the golden ticket they received in the mail said so.

How do you choose a credit card you ask, well here are some general tips I can give about which cards to choose.

- Department store cards are garbage.

- Paying anything above 10% interest is ridiculous.

- Almost all cards come with rewards, your card should too.

- Reward cards are only worth it if you actually use the rewards.

- Always read the fine print. Did you know that if you miss a payment some cards will boost your interest rate from 9.5% to 19.5%? Holy $hit, right?

- You should not have to pay an annual fee to have a good credit card.

- Don’t let them raise your credit limit by more than $5000. You shouldn’t need to spend any more than that at one time on your card and if your credit card is “for emergencies” you’re delusional. Start an emergency fund instead and have the bank pay YOU interest, not the other way around.

I used to have 3 credit cards, an AMEX, a department store card, and my MasterCard. I got rid of the department store card because they took me to a collection agency (to my credit they never sent me a bill so I forgot about paying it). This was a good thing since the interest rape (not a typo) was somewhere in the 20th percentile. The other card I got rid of was my AMEX because it had a zero balance. You can only cancel a credit card when it has a zero balance. I should have kept it because the interest rate was only 9%. The card I did keep is my MasterCard. I’m currently carrying a $14,247.57 balance on it. Yes, I am constantly in the process of being gangbanged by MasterCard. My MasterCard had an interest rate of 19.5% which means that every month, I was paying $236.95 in interest!!

Now, if you’re like me and carry a lot of credit card debt, you would be wise to transfer your balance and consolidate your debt into a lower interest line of credit so that you can pay down your principle balance faster (which will save you a ton of money). This however wasn’t the case for me. I tried to do this and the bank said “no.” I carry way too much debt for the bank to be interested in giving me more credit. Desperate times call for desperate measures. Since I can’t get rid of my credit card debt by consolidating it, I got my interest rate reduced from 19.5% to 12.5%! Doing this is surprisingly easy to do. I used the following script (brilliantly provided by the NDP):

“Hello, my name is YOUR NAME.

I have been a good customer of yours and would really like to stay with CREDIT CARD NAME.

I’d like to talk with someone about lowering my current credit card interest rate. Can you help me with this?”

It was THAT simple. For more information on this, check out this website. By having my interest rate lowered to 12.5%, I am instantly saving almost $100 per month interest. Talk about amazing.

Another dumb thing I was doing was paying for balance insurance on my credit card. This was probably the stupidest thing I’ve ever let the bank talk me into. I paid an additional $60 per month to insure my balance in the event that I die. That boosted my interest rate up into the 20% range! If you get offered this “feature” – decline it! It’s not worth it at all. And yes you can cancel it at any time.

If you can maintain your good spending habits for 6 months, go back to your bank and they might actually start considering consolidating your debt. Talk to your friends and see what kinds of credit cards they have and shop around for the best one for you! Credit card debt is a nightmare, but if you can learn to take your card, throw it behind the fridge, not use it, and pay that mother trucker off, you can be quickly on the road to financial freedom like me.

Love,

John

Wednesday, October 27, 2010

Cut the Crap

|

| Baby Boomers like big white underpants. |

Okay Spendy Spenderson, It’s time to get real and see where you can cut out some of the crap in your life. I’m a child of parents from the baby boomer generation. The generation that told their kids that we can be whatever we want to be and have whatever our heart’s desire when we get older. The problem is that the boomers failed us in teaching us how to afford getting there and that you need to save for it. I hear all too often from my parents’ generation that we are spoiled and we feel too entitled but where the H-E-double-hockey-sticks do they think we learned that from? Why am I not a zookeeper, finishing his PhD who owns an apartment building and just won the latest election to become Prime Minister? The truth is the message was a good one, work hard and you can have whatever you want, but they didn’t lead by example (Okay Gail, you’re an exception to the rule).

As you may have read from my last post, my spending is all over the map and I’m not putting any of it where it should be – into my savings account. As confessions_of_an_ordinary and myself highlighted in my last post, my “restaurant expense is way too high.” There’s a restaurant across the street from work (that is so effing delicious and would become a fast growing chain if Rita MacNeil ever discovers it) which I was eating at on average of 2 times per week and at $8 an order that’s freaking expensive. If you’ve tried their General Tao Chicken you would be able to understand. But really, think about it, there are 52 weeks in a year, multiplied by 2 multiply that by 8 and I’m spending $832 per year on ONE restaurant! And the worst part is that I’m paying to expedite my office-worker belly! Now the other bad news is that I also ate out every other day of the week at other restaurants and the average cost was about the same. So let’s take $8 multiplied by 52 weeks, multiplied by 5 work days for a grand total of $2,080 per year on lunches!

After doing my analysis, places that I frequented became highlighted and I was able to say “oh ffffiretruck, I’m wasting my money.” This is when you sit down with your stuff and scrap the crap. Good news is that you won’t have to invest in any more Depend undergarments since you will no longer be $hitting your pants from the shock of your analysis. So what do you cut? Well, you need to figure out how much money you should be spending in each of the following 5 (Gail approved) categories so that you know how much you have to live on:

Savings: 10%

Debt Repayment: 15%

Transportation: 15%

Life: 25%

Housing: 35%

This is Gail’s list, but she does allow for some tweaking here and there and no offense Gail, but some of us are capable of getting into debt long before we have kids and a house payment. So here’s my single-childless-guy-living-downtown-without-a-car budget:

Savings: 15% (10% for long term, 5% for ‘wants’ and emergency fund)

Debt Repayment: 45%

Transportation: 1%

Life: 14%

Housing: 25%

|

| Quit reading picture captions and get a Life! |

I’ll go into further detail about Savings, Debt Repayment, Transportation, and Housing in future blogs so for now let focus on Life! Life cereal is delicious, and Life the board game can provide hours of family fun. Just kidding guys, Life cereal is kind of blah, and Life the board game has too many pieces for children to choke on and for me to lose. Okay, okay, Life is the category where all your groceries and personal care, clothing, gifts, entertainment, and other unplanned expenditures show up such as the dentist, doctor, meds, pets, etc. In my case, my life category works out to just $94.11 per week to spend on ALL of these things. If you’re anything like my friends, you’re all saying, “no freaking way can you live on that!” Well for the past 3 weeks, I have been. When you add in the cost of bus tickets (which I almost never use) my total allowance for 1 week is $100.83. I rounded down to $100 for simplicity sakes. Here’s what it looks like in actual money:

Transportation: $6.00

Clothing & Gifts: $10.00

Groceries and Personal Care: $40.00

Entertainment: $38.00

Other: $6.00

Are you nucking futs?!? That’s generally what I hear (with the letters switched) when I tell people this is the amount of money I live on every week. Keep in mind that this money accumulates every week that I don’t use it all and I can dip into each amount to cover for each other. What was really nucking futs was that I was spending 87% of my income on “Life.” $2,543.66 in actual money! I reduced my “life” spending by 73%!! This journey is going to be quite arduous. In my next blog I will get more in detail about my debt, which is the reason I’m forced to live as though I’m a first year student who’s pi$$sed through their student loans in their 2nd week of university. So my generation, you so-called self-entitled spoiled brats, and all you baby boomers out there too, pay attention because you just might learn a thing or two! If you do learn something, pay it forward, you’d be surprised how grateful people are to be able to talk about their finances with someone who has lots of knowledge about it.

TTFN!

John

Subscribe to:

Posts (Atom)