My loyal readers, thank you again for all the support over 2011. I really feel like this has been my year. There are so many great things that I have accomplished. My biggest achievement was finding a permanent job that includes a great pension and benefits package that will keep me less at risk to getting into further financial trouble in the future. Not only that, I now get paid to be on vacation, which is a first for me in my entire working life. It feels great to be writing this blog post in sunny, snowy, Saskatoon while getting the opportunity to relax with my family and friends without worrying about my finances. I can't think of a better way to wrap up the year!

Being back home really reminds me how lucky I am. Not only have I come back to Saskatoon for the second time this year and I have taken trips to Halifax and Las Vegas while managing to stay right on track with my debt repayment - have you seen the numbers? It is so incredible to think that I am not far from being halfway finished my goal of paying off my debt and that I will not have any debt left on my credit card.

All this being said, I didn't manage to do one thing which I had set out to do at the beginning of this year, and that was to make sure that I write one blog post per week. I got pretty close though, this will be the fiftieth! For someone with a demanding schedule like mine, I think I did pretty good, and my readership numbers have proven it! I'm now close to having 9000 reads which lets me know that it's more than just my friends and family who are reading about my challenge and my struggle to pay this all off in such a quick amount of time.

The new year is going to present its own challenges for me. As soon as I get back home, I start on full-time French training! This could end up being something incredible for me since I will be one step closer to being bilingual, or I could end up feeling really high strung. I'm hoping that this will feel like a bit of a break for me though and I think it will help me get back on track with my budget because I won't have such a wonky schedule. Not only that, this should give me more opportunities to do yoga consistently again. I know that we all make resolutions to be in better shape or to exercise more, but I'm taking this one seriously. I want to try to do yoga at least 3 times a week. I think that can be completely possible. When you undertake something stressful like debt repayment, your physical health will help you to keep focussed and deal with stress more than if you are not taking care of yourself.

2011 was a great year for me for a lot of reasons which you can read about in my past blog entries. Taking control of your finances helps you to take control of your life. If you are thinking about what to do for your new years resolution, I highly recommend that you do this process. Not only is it possible, but you will have my support to see it through as a success. I look forward to getting back on track in the new year and sharing some new pearls of wisdom with you all!

Happy New Year Everyone!

xo

John

Friday, December 30, 2011

Sunday, December 11, 2011

Shopping Day!

|

| Nice Package! |

I woke up

today to a loud bang followed by a shaking feeling thinking that a bomb had

gone off, which I think was my body’s way of putting me into flight mode. Why?

Because today was my big Christmas spending shopping day! Without giving

away too many details, I think I may have gone a little bit overboard, but I

did pretty damn good too! It’s not really a big deal that I overspent in my

mind though, because I still managed to pay down a huge chunk of debt and

maintain a certain level of sanity at the same time (always a plus in my book).

Overall the shopping experience wasn’t too bad with a few exceptions of

ridiculous shoppers and obnoxious sales staff. I do have to sympathize for

people who work at a mall during the holiday season though. Usually it’s a bunch

of students who are already stressed out with exams and projects to finish on

top of having to be friendly with stressed out people at the same time so I wasn’t

surprised when I got into a discussion about whether the colour of the item I

was looking at was not black but rather a navy blue, to which she tried to tell

me that navy blue is just another form of black. You’re not pulling a fast one

on me girlfriend, okay?

In terms of

the budget for my family get-togethers, I have done well so far. The first gift

is perfect, but I’m worried that it won’t be something that everyone wants. I

guess that is what makes a Secret Santa without names a little difficult. I

don’t want to buy something that only the girls will like, and I don’t want to

buy something that only the boys will like either. Decisions, decisions! All I

have left to find is another $25 gift. I saw a few things that I know will be

good, but now I need to decide which will be the best of them. There were some other things that I wanted to

get but I knew that I would be able to find them cheaper online, so I have been

sleuthing around the internet and I think I found the perfect thing for the

perfect price. Now it’s just a matter of whether or not I can get the item to

my place in time before I leave! I hope I’ll figure it out before Christmas!

|

| Aka, Negative Nancy |

I am being faced

with another little problem though. My mom emailed me and asked what my

boyfriend wants for Christmas and now I feel like I need to buy something for

my parents, which is not something I had planned. I don’t like being hit with

unexpected surprises in my budget, but I guess that’s why Gail is always

stressing that I have an emergency fund! So if I end up buying something for my

parents, that’s going to add (give or take) another $100 to my spending for the

holidays. Realistically that isn’t so bad, but I would rather have the money to

be able to go out for dinner with my parents instead of getting them something

they won’t use or remember, or even worse, return it for a god awful baby-blue-and-neon-pink

sweater. Seriously, I did not approve that purchase Mom! If I do decide to go

out and spend on my parents, then I will make sure to keep it smart, unlike the

person I overheard at the mall saying that he had to spend at least

$100 on a pair of gloves. Are you effing kidding me? I can’t believe

that I used to be that person. I remember spending almost $300 on a sweater. I

love that sweater to death and get complimented on it every time I wear it, but

man I would gladly trade it for 6 equally nice $50 sweaters right about now.

|

| Umm... Boney M? |

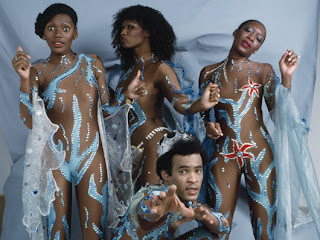

Now without

sounding like Negative Nancy or Debbie Downer, I am getting really excited for

the holidays! There are so many frustrating moments leading up to the holidays,

but maybe the past couple Christmas parties I have attended are getting me in

the mood to celebrate. All I need is a little Boney M Christmas and some

Christmas drinks and I am good to go. It also helps that my family has started

to message me and tell me how happy they are that I am coming back to visit. A

big part of me really wants to just let go of my budget while I am on vacation,

and I think that I will simply because I have achieved so much over this past

year. I will still stay away from credit, but I will maybe put a little less

toward my debt repayment and a little more on myself. I know, I know, it’s not

the best thing to do, but at this point it just feels right. Alright, I only

have 4-5 more Christmas celebrations to go now! Wish me luck everyone, and see

you next week!

Tuesday, December 6, 2011

Scare Tactics

|

| Scare tactics are effective on the elderly |

One of the

most remarkable things about writing a financial blog is how open people become

when talking to me about their own financial struggles. Listening to other

people’s challenges and successes gives me a lot of reassurance as well as tons

of hope that I can continue to get ahead with this process. A common theme in

the discussions I have with people who still carry debt is that most don’t have

any idea how they can get their debt paid off. Fortunately I have tons of ideas

to help them out. The part that usually baffles me though is how long people

are willing to wait to pay off their debt in full.

For

example, when I look at my current “repayment plan” for my student loans, my

lender projects that I still have another 89 months (7 years and 5 months) of

minimum payments to go before I will pay this off entirely. Not only that, the

amount of interest I will end up paying is $1,837.78. I hate dumping any of my

hard earned money onto interest payments so when I hear about people being

comfortable with paying off a small amount of debt over such a long amount of

time, I want to smack them over the head and tell them to wake up. I get it, we

all feel entitled to the best of the best, and since we work hard, we should be

rewarded. The problem is that if you keep resorting to credit to buy everything

you want, you could end up with nothing when the debt gets quickly out of

control.

If you were

like I was, teetering on the brink of financial disaster, you need to stop and

take control of your situation before it gets unmanageable. There are some

major signs that you should be weary of such as: not being able to make more

than the minimum payments on your bills; not knowing how much debt you have;

living paycheck to paycheck; having no savings; creditors constantly call you

for payments; you remortgage your house every other year; and the list goes on.

I recently read an article (I’m sorry I can’t remember where) where most

financial advisors said they wished that people would have come and seen them

sooner to deal with their finances rather than later because most of the time,

they are too far gone to be helped and they have to file for bankruptcy. This

couldn’t be any truer. If you are like I was with my money, look for something

that will motivate or inspire you to get your debt repaid. For me, I can think

of a lot of things I would rather do with $1,800 other than use it for interest

(like a mini vacation), and not to mention how less stressed I get as the debt

numbers go down. Debt repayment is work, but when you build a strong support

system like I have, it is completely possible to do.

|

| Canada's Debt Clock! |

Ok, so you

may be wondering what is with the scare tactics/pep talk? In one of the

conversations I had recently with someone who I don’t even really know, she

told me about Canada Canada Canada

But what

can we do to reduce this number, right? We can’t be responsible for other

people’s neglectful spending, but we can certainly do our part to encourage

others to start spending money smarter, especially over the holidays. In a

country where we buy everything we want on credit, I find it surprising that

people have anything left to buy for each other at Christmas that they don’t

already have! Just like last year, I want to emphasize that there are so many

ways that you can save money this year during the holidays.

|

| Make a shopping list like Santa!! |

When you

are out shopping, be like Santa and make a list. Making a list when you shop

will help keep you on track with what you want to buy for your loved ones. Try

to keep the list as specific as possible, and write down the items that you

want to buy even for the stores where you know what you want to buy and put a

price limit on how much you want to spend. If you want to go the extra mile,

look for deals online for items that you want to buy and save yourself even

more money (as long as the shipping isn’t ridiculous). If you can stick to a

list, you will have an easier time staying on budget.

Leave the

credit card at home. This is a general rule for me everyday, but it’s even

better to put into practice during the holidays. You shouldn’t have to go into

debt just to buy everyone you know a gift, and nor should they. Don’t ever feel

bad about giving a friend a card or simply asking your family to do a gift

exchange instead of buying each of them a gift. And if you’re doing a gift

exchange with friends, think doing what my friend Gigi does and have everyone

re-gift something that they don’t use! This idea is not only a great way to

recycle, but it is also a hilarious way to spend time with your friends during

the holidays!

Be

thoughtful with your gift giving. Can you think back to 5 Christmases ago and

remember everything you got? Even better, can you remember all the things that

you bought for your loved ones? I find that the gifts I remember the most are

the ones that were made by someone. I

remember one year when my brother blew up a picture of us as kids working with

my Dad. He was so moved by that photo, which it really made the whole day a

wonderful and memorable experience for us all (and no, it wasn’t even Christmas

day). I can’t tell you what I got for the past few years other than maybe some

money but I don’t even remember the amounts. What I do remember are the fun

times that I had with my family which I guess is why I go back home year after

year.

The

holidays can be the most stressful time of the year, or they can be the most

exciting and memorable. With the debt counter climbing higher, take time to

stop and think of ways that you can contribute to reducing your debt instead of

augmenting it this season. The holidays will become less stressful if you plan

ahead and use your own money, not the banks’. If you’re reading this and

thinking, “well $hit John, it’s too late now”, then perhaps you should make it

your new year’s resolution to put $25 a week into a special “Christmas Savings”

account and by this time next year, you will have $1,200 to spend ‘til your

heart’s content.

Subscribe to:

Posts (Atom)